© Copyright 2024 Tella (New Zealand) Limited. All Rights Reserved. Powered by Tella.

Does an OCR drop automatically mean lower home loan rates?

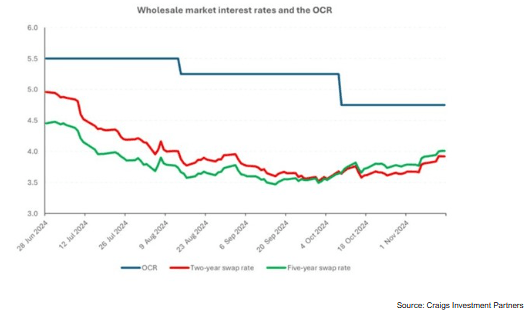

Exciting news for homeowners and anyone considering buying a home! We're approaching the 27th of November, and most experts predict the OCR will drop to 4.25%. This could mean lower interest rates and potential savings!!

However, there's a twist: While this is great news, it's important to remember that fixed mortgage rates are influenced by debt swap rates, which has been creeping upwards in recent weeks. This means even though the floating rate might drop, fixed rates could go the other way.

So, what does this mean for you?

If you've been waiting for mortgage rates to drop further, it might be a good idea to lock in a rate today before they potentially increase. Click here to book in a time to chat with one of our mortgage experts – we can help you find the best option for your situation.

Positive Market Trends

Real estate agents are also reporting a more positive outlook, with buyers and sellers connecting and properties selling faster. While house prices may remain flat, there's a renewed sense of activity in the market. With increased buyer activity and properties selling faster, now is a great time to seize the opportunity and secure your dream home.

Refer a Friend and Earn $250!

Know someone who's looking for a mortgage? Refer them to Tella, and if they take out a home loan before 31/01/2025 of over $100,000 directly through Tella, you'll receive a $250 bonus. It’s our way of saying thanks for spreading the word.

Ready to take the next step?

Let's unlock your homeownership dreams! Book a free, no obligations, chat with one of our home loan specialists today.

We’re here to guide you every step of the way.