© Copyright 2024 Tella (New Zealand) Limited. All Rights Reserved. Powered by Tella.

Lower Interest Rates & Easier Approvals: Tella's here to help.

Great news for homeowners and aspiring homeowners! Recent market changes are creating exciting opportunities to save money and achieve your homeownership goals.

Lower Interest Rates

Interest rates are finally heading in the right direction after a period of steady increases. This is largely due to the Reserve Bank’s efforts to manage inflation and global economic factors influencing interest rates.

Easier to Qualify for a Home Loan

The government has made it easier to qualify for a home loan by relaxing the Credit Contracts and Consumer Finance Act (CCCFA) regulations. This means lenders can take a more holistic view of your financial situation, increasing your chances of approval.

What this means for you

- Lower Monthly Repayments: Enjoy more financial freedom with reduced mortgage payments.

- Increased Borrowing Power: Qualify for a larger loan to purchase your dream home or invest in your property.

- Potential to Refinance: If you have an existing mortgage, explore refinancing options to take advantage of lower interest rates.

- Faster Approval Process: Streamlined processes can lead to quicker loan approvals, saving you time and hassle.

Understanding the Bigger Picture

To give you a better understanding of how interest rates work, it's helpful to know that banks fund their loans through a mix of deposits, equity, and wholesale debt.

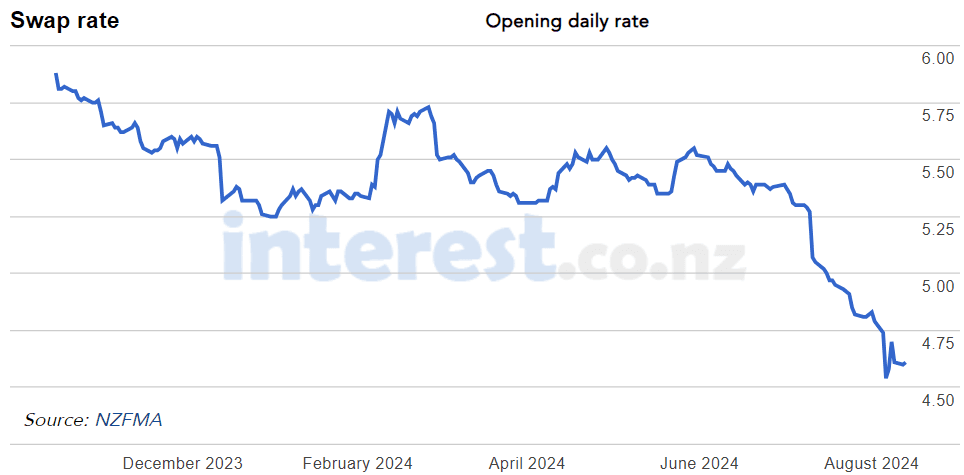

The cost of wholesale debt, measured by interest swap rates, has fallen significantly in recent months (see 1 year swap rate graph below). This is the primary driver of the decline in home loan rates.

Next Steps

Ready to take advantage of these positive market conditions? Book a free, no obligations, chat with one of our home loan specialists today to explore your options.