© Copyright 2024 Tella (New Zealand) Limited. All Rights Reserved. Powered by Tella.

Maximise your savings: Navigating today's mortgage market

Have you noticed the buzz in the property market lately? There's a sense of change in the air, with agents reporting increased activity and developers starting projects again. This isn't just talk – it's a genuine shift, and we're seeing some interesting trends emerge. Let's delve into what's happening and how you can make the most of it.

Here’s what we’re seeing:

- Real Estate Optimism: Agents are reporting a noticeable improvement, with increased activity and faster sales.

- Developer Confidence: Property developers are restarting projects after a two-year pause, signalling renewed confidence.

- Lender Aggression: Banks are actively competing for business, leading to a more favourable lending environment. This combination of factors presents exciting opportunities for those looking to buy or refinance.

While we're not seeing the historically low 3% interest rates (and likely won't again), rates below 5% are significantly better than the 40-year average of 7%. Notably, over the past few months, we've seeing banks becoming more flexible with loan approvals, making it easier to get that home loan.

Looking ahead, the global landscape remains uncertain, with events like gold now above USD$3,000/ounce which is a sign of investors rushing to safety. However, within our industry, we expect:

- Further OCR Cuts: We align with bank economists who predict the Official Cash Rate will fall to 3-3.25% by year's end.

- Lower Fixed Rates: It's possible longer-term fixed interest rates (3-5 years) could drop to or below 5% by the end of the year, driven by both economic factors and banks' need to grow their portfolios.

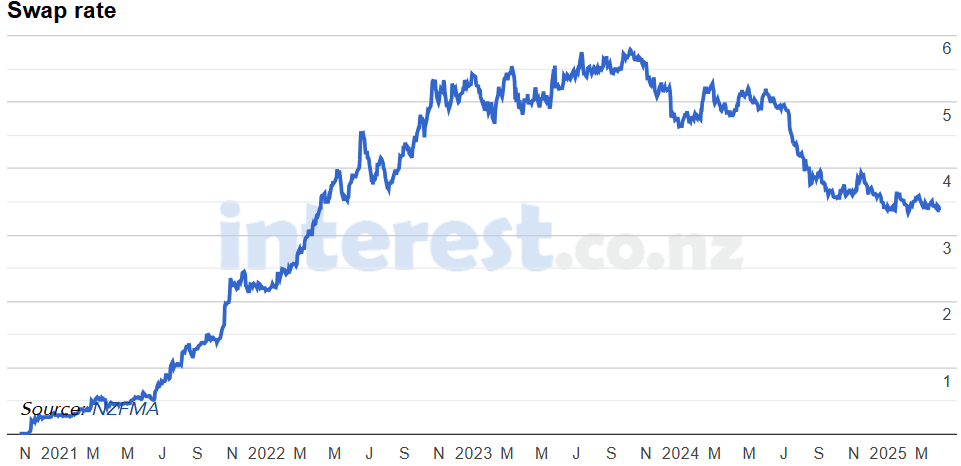

2-year swap rates: The downward trend is a key indicator of potential reductions in fixed mortgage rates.

2-year swap rates: The downward trend is a key indicator of potential reductions in fixed mortgage rates.

What This Means for You:

Increased Borrowing Potential:

- The current lending environment can open doors to increased borrowing capacity, allowing you to pursue your property goals.

Strategic Savings Opportunities:

- Potential further interest rate reductions present opportunities to optimise your mortgage and reduce long-term costs.

Proactive Decision-Making:

- Understanding these market dynamics enables you to make informed, timely decisions to maximise your financial position.

Your Next Steps:

- Book a free chat: Let's discuss your specific situation and develop a tailored plan.

- Stay Informed: Keep an eye out for our updates as the market evolves. We're here to guide you through these market shifts and help you capitalise on the opportunities.

Whether you're looking to buy, refinance, or simply understand your options, we're ready to assist. We're committed to providing you with clear, actionable advice to help you achieve your homeownership and financial goals.