© Copyright 2024 Tella (New Zealand) Limited. All Rights Reserved. Powered by Tella.

Reserve bank cuts OCR again

The Official Cash Rate has been reduced again (as widely expected), this time by 0.25% to 3.50%.

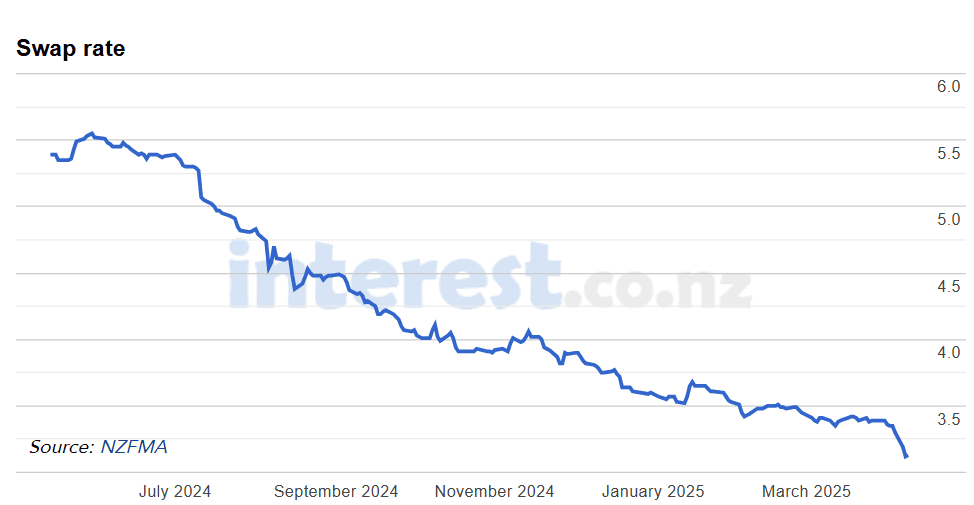

While some banks have already reduced their floating rates as a result of this announcement, we're watching closely to see how (and if) fixed interest rates will respond. The impact of global trade uncertainties, like Trump's tariffs, also adds a layer of complexity to where rates might head. We're also seeing movement on the swap curve:

1-year swap rates: The downward trend is a key indicator of potential reductions in fixed mortgage rates.

1-year swap rates: The downward trend is a key indicator of potential reductions in fixed mortgage rates.

Regardless of how interest rates settle, taking proactive steps towards your financial goals is always a smart move. Even with these wider economic shifts, you can still take charge of your financial situation. This latest OCR move is a good reminder to review your options, whether you're aiming for your first home, considering investment, or just want to ensure you have the best mortgage deal.

Book a free, no obligations, chat with one of our home loan specialists today.

We’re here to guide you every step of the way.